- In general, you are eligible to exclude the gain from income if you have owned and used your home as your main home for two years out of the five years prior to the date of its sale.

- If you have a gain from the sale of your main home, you may be able to exclude up to $250,000 of the gain from your income ($500,000 on a joint return in most cases).

- You are not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home.

- If you can exclude all of the gain, you do not need to report the sale on your tax return.

- If you have a gain that cannot be excluded, it is taxable. You must report it on Form 1040, Schedule D, Capital Gains and Losses.

- You cannot deduct a loss from the sale of your main home.

- Worksheets are included in Publication 523, Selling Your Home, to help you figure the adjusted basis of the home you sold, the gain (or loss) on the sale, and the gain that you can exclude.

- If you have more than one home, you can exclude a gain only from the sale of your main home. You must pay tax on the gain from selling any other home. If you have two homes and live in both of them, your main home is ordinarily the one you live in most of the time.

- If you received the first-time homebuyer credit and within 36 months of the date of purchase, the property is no longer used as your principal residence, you are required to repay the credit. Repayment of the full credit is due with the income tax return for the year the home ceased to be your principal residence, using Form 5405, First-Time Homebuyer Credit and Repayment of the Credit. The full amount of the credit is reflected as additional tax on that year’s tax return.

- When you move, be sure to update your address with the IRS and the U.S. Postal Service to ensure you receive refunds or correspondence from the IRS. Use Form 8822, Change of Address, to notify the IRS of your address change.

Real Estate investors who want to sell or buy for the right price turn to Edward Torrez. Ed is the knowledgeable, professional Broker who works at a higher level to move rental property and to bring savings to sellers--The Investor's Broker.

Monday, August 22, 2011

IRS's Summertime top 10 tax tips for home sellers

Labels:

Tax Tips

Wednesday, July 13, 2011

Which State has the Most Mortgage Fraud?

Reports of mortgage fraud are on the rise: A government agency reported this week a 31 percent jump in mortgage fraud cases for the first quarter of this year, largely attributed to additional reviews from banks of loans issued several years ago that now have gone bad.

California cities dominated the rankings for the highest incidences of mortgage fraud in the nation — occupying six of the top 10 spots, according to the report issued by The Financial Crimes Enforcement Network.

The following is a list of the top 10 metro areas with the highest reports of mortgage fraud in the first quarter of this year, according to the Financial Crimes Enforcement Network.

- San Jose-Sunnyvale-Santa Clara, Calif.

- San Francisco-Oakland-Fremont, Calif.

- Los Angeles-Long Beach-Santa Ana, Calif.

- Riverside-San Bernardino-Ontario, Calif.

- Sacramento-Arden-Arcade-Roseville, Calif.

- Miami-Fort Lauderdale-Pompano Beach, Fla.

- San Diego-Carlsbad-San Marcos, Calif.

- Las Vegas-Paradise, Nev.

- Atlanta-Sandy Springs-Marietta, Ga.

- Salt Lake City, Utah

Monday, July 4, 2011

What is Due Diligence?

Most buyers and sellers share similar frustrations in the current housing market. Buyers look long and hard for the right home to buy, exercising caution to make sure they don't make a mistake that could be costly. Sellers wait anxiously for a committed buyer who sees the value in their home and is willing to put pen to paper.

There are exceptions: Relatively hot neighborhoods surrounded by areas of sluggish sales. But, typically, negotiations between buyers and sellers are lengthy and tedious -- neither ending up with exactly what they want, but something they can live with.

The negotiations often don't end when the contract is ratified. Ratification occurs when the initial offer and all counteroffers are signed and accepted by both parties. The buyers' lender can be the source of problems like refusing to lend the amount the buyers need to close the deal, either due to a low appraised value of the property or a problem with the buyers' credit.

A major cause for further negotiations is inspection-related issues. This can encompass a broad range of problems from physical defects with the structure itself, like faulty electrical wiring, to discovering something previously unknown about the neighborhood like the fact that it's zoned for multi-dwelling housing and the house next door is being converted into a 12-unit building.

HOUSE HUNTING TIP: Do as much due diligence investigation as you can about a home you're seriously considering buying before you make an offer. It's time consuming and emotionally draining to make an offer. If you can discover in advance that there is something about the home or neighborhood that you can't live with, you come out ahead.

Some sellers provide a disclosure package about their home that provides presale inspection reports and information about the property. If so, read and understand these before you make an offer. A seller's disclosure package should not be viewed as a substitute for doing inspections once your offer is accepted. You should include an inspection contingency in the contract.

There is a certain amount of subjectivity involved in home inspecting. One inspector might say the roof needs to be replaced; another could think the roof is serviceable and will last another few years with maintenance. One inspector might see a crack in the foundation as a big deal; another could find it typical and not affecting the integrity of the building.

Usually home inspections recommend further inspections for such systems as the furnace, hot water heater and drainage system. Few sellers take the steps to have all recommended further inspection done.

During the buyers' inspections, issues that the buyers thought wouldn't be a big problem can turn out to require expensive fixes. Or new defects are uncovered of which neither buyer nor seller was previously aware. These situations can lead to further negotiation.

Buyers should be aware that a contract may not permit you to simply cancel without penalty if you decide you don't like the house after taking a serious look at it. It depends on the wording of the inspection contingency. Make sure you understand this before you sign the contract. In some cases, the buyers are required to request that sellers make repairs. The seller may have no responsibility to do so.

However, buyers should consider how long they have looked and how difficult it will be to find another house like the one they're trying to buy. Sellers need to realistically assess how difficult it might be to find another buyer if they have to put their home back on the market.

THE CLOSING: It's usually in both parties' interest to try to reach a mutually satisfactory solution, either in the form of a credit to the buyers, the sellers getting work done, or a price reduction.

Always do your homework, and be guided by the licensed professional you are paying to educate and help you.

Labels:

What is?

Do you or a family member have unclaimed money in California?

Unclaimed Property is generally defined as any financial asset that has been left inactive by the owner for a period of time specified in the law, generally three (3) years. The California Unclaimed Property Law does NOT include real estate. Unused gift certificates are also generally excluded from unclaimed property and are not sent to the State as unclaimed property.

The most common types of Unclaimed Property are:

- Deposits for utilities

- Bank accounts and safe deposit box contents

- Stocks, mutual funds, bonds, and dividends

- Uncashed cashier’s checks and money orders

- Certificates of deposit

- Matured or terminated insurance policies

- Estates

- Mineral interests and royalty payments

- Trust funds and escrow accounts

Remember this can apply to anyone you know. Do you really know what your parents may have done before you were born. Or what they did when they were single. It doesn't hurt to check, you might find money for a family member. Good Luck!

Labels:

Bargins Deals and Steals

Friday, July 1, 2011

Boyle Heights Neighborhood Council Elects New Board Members for July Fiscal Year 2012!

Boyle Heights Neighborhood Council Elects New Board Members on June 29, 2011 at Pueblo del Sol Community Center.

The newly elected members are:

- President Rocio Gandara

- Vice President Eddie Padilla

- Secretary Margarita Amador

- Treasurer Vera del Pozo

- Outreach and Special Events Officer Randy Salinas

- Planning and Land Use Officer William Morris

The meeting was interesting to say the least with a parliamentarian guiding and directing proper meeting procedures. Though the meeting went passed the allotted time frame of 8:00 pm. It was interesting to see and hear the challenges that have plagued this Voluntary Board.

Good Job!

Labels:

Boyle Heights

Monday, June 27, 2011

5 Foreclosure Myths You Didn't Know!

Although there are a number of programs available to help homeowners who have defaulted on their mortgages keep their home, the large amount of misinformation tends to result in troubled homeowners failing to contact their lender until it is too late.

Making sense for my readers:

Making sense for my readers:

- Some homeowners believe, incorrectly, that contacting their lender early in the process will draw attention to their situation and result in a quicker foreclosure. In reality, contacting the lender or servicer is an important first step, and the sooner, the better. Contacting the lender provides the homeowner with an opportunity to explain their situation and the steps necessary to deal with it.

- It is a common misconception that missing one mortgage payment will lead to foreclosure. However, the foreclosure process doesn’t begin until payments are 90 days delinquent. Lenders generally have a financial interest in keeping homeowners in their homes, so making contact as early as possible could help lenders modify terms of the mortgage or devise a repayment plan.

- Once homeowners are behind on their mortgage payments, it becomes challenging to dig out of the hole. Some homeowners try to solve this by depleting their savings or dipping into their retirement accounts to become current on the loan. Most financial experts advise against this.

- Delinquent homeowners may think they should stop making mortgage payments to get their lender’s attention, which often isn’t the case. When possible, homeowners should stay current on their mortgage payments and continue to contact their lender on a regular basis.

- Homeowners who have applied for assistance or loan modification programs in the past and were turned down are advised to reapply. Program parameters are constantly changing, so the rules might have been liberalized since the last time the borrower sought help.

Labels:

Foreclosure News,

Making Sense

Monday, March 28, 2011

Your Taxpayer Rights if You Ever Get Audited

There are 3 letters that strike fear into the hearts of Americans—I-R-S!

And the very thought of being audited by them—usually turns into panic.

What you might not know is that back in the 1990’s, Congress passed the Taxpayer Bill of Rights Law, which places the burden of proof in tax disputes on the IRA -- not the taxpayer.

However, there are some additional rights you have if you ever get that dreaded “audit notice” in the mail.

- You don’t have to meet with the IRS – You don’t have to meet with them face to face. Instead, you can conduct your “audit” thru the mail. You avoid the stress of a personal meeting, the hassle of taking time off of work, or saying something that might be misconstrued by the auditor.

- You have the right to negotiate penalties – Of course, the IRS is not going to tell you this, but if you’ve filed your tax returns, acted in good faith and have not set out to deceive the IRS or dodge your tax liability, you can ask that any penalties be cancelled.

- You can appeal decisions made by the IRS - If you believe the tax liability and penalties are unfair or incorrect, you have 30 days to file an appeal. However, it could take years before your case is heard, but the “filing” date is the critical part of this process.

- You have the right to “installment” payments – Let’s say you do end up owing additional money, you can set up regular monthly payments with the IRS. Form 433A needs to be filed, listing your income, expenses, assets and liabilities. They will determine the monthly payment you need to make.

- You have the right to challenge IRS notices – Just a little fewer than 50% of all IRS notices, requesting more money from you, are incorrect or incomplete. But they keep sending them because it has been shown that people would rather just pay the money than fight the IRS. Don’t take their word for it.

- You have the right to use a Taxpayer Advocate – If you feel you are getting the run around or no one at the IRS is willing to help you, contact a taxpayer advocate. This is a division of the IRS to help citizens whose tax problems seem to be ignored. Visit the IRS website and you’ll find a link that says “Contact Your Advocate”. The service is free and it’s confidential.

- You have the right to make audio recordings when you meet—yes, you can record the whole meeting but you have to notify the IRS 10 days in advance.

- You have the right to represent yourself at an IRS audit – The tax code is complicated and unless you are fairly competent about the specifics of your tax audit, you might want to hire an expert to help you. If you’ve had your tax returns prepared by a CPA, they will usually help with the audit meeting. If you end up in US Tax Court, hiring a tax expert is highly recommended.

Labels:

Tax Tips

Friday, February 25, 2011

Banksy Visits Boyle Heights California And His Work Is Saved!

Ed Torrez

Banksy Kite-2

(Image From His Site)

(Image From His Site)

|

| Ed Torrez Banksy Kite-2 Found in Boyle Heights, California (1st Street and Mathews) Ed Torrez Banksy Kite-2 Tagged Ed Torrez Banksy Kite-2 Saved From Taggers and Graffiti Abatement Crews! |

Labels:

Boyle Heights,

Misc.

Monday, February 21, 2011

Mortgage Pitfalls to Consider

Getting a mortgage is a complex, time-consuming process that is generally one of the most significant events in one’s life. Because of this, there are several potential pitfalls borrowers should avoid.

- Applying for new credit and a mortgage simultaneously is never recommended. Anytime a borrower applies for new credit, the borrower is seen as a greater credit risk, at least initially. If the borrower also applies for a credit card or auto loan around the same time as applying for a mortgage, the borrower’s credit score might get dinged enough to increase the interest rate applied to the loan, or disqualify the borrower altogether. Borrowers should first apply for a mortgage, then apply for other consumers loans after the mortgage has been funded.

- Another mistake some borrowers make is failing to look at the total housing payment. A mortgage payment consists of principal, interest, taxes, and insurance (PITI). Commonly, some prospective home buyers forget to factor in the property taxes and insurance premium into the overall mortgage budget.

Labels:

Making Sense,

Mortgage News

Monday, February 14, 2011

Is Real Estate a Good Investment?

The housing market still looks pretty bleak: There were a record 1 million foreclosures last year, home prices are still falling in many regions, and the number of "underwater" properties is at a record high.

And things don't look much better in other areas of real estate. The number of construction jobs continues to decline, even as other parts of the economy have added jobs. And mortgage rates have moved higher as long-term Treasury yields have backed up during the past few months.

Basically, the real estate market remains a mess.

Real estate encompasses a wide range of markets – homes, apartments, hospitals, office buildings, strip malls, dormitories and other properties. But for our purposes, let's focus on residential real estate, or homes. Here are four reasons to think residential real estate might represent a bargain – with one big caveat.

MAKING SENSE FOR MY READERS

And things don't look much better in other areas of real estate. The number of construction jobs continues to decline, even as other parts of the economy have added jobs. And mortgage rates have moved higher as long-term Treasury yields have backed up during the past few months.

Basically, the real estate market remains a mess.

Real estate encompasses a wide range of markets – homes, apartments, hospitals, office buildings, strip malls, dormitories and other properties. But for our purposes, let's focus on residential real estate, or homes. Here are four reasons to think residential real estate might represent a bargain – with one big caveat.

MAKING SENSE FOR MY READERS

- Everyone hates homes - When the housing market is in the doldrums, people tend to avoid thinking about the value of their home. Sellers complain they’re not getting offers and buyers bemoan the strict lending requirements. However, prospective buyers should be contrarian and take advantage of a down housing market.

- Smart people are buying real estate - A prominent hedge-fund manager said in a speech last fall: “If you don’t own a home, buy one. If you own a home, buy another one, and if you own two homes, buy a third and lend your relatives the money to buy a home.” He believes that interest rates and home prices will rise this year, so real estate bargains won’t last much longer.

- Real estate performs well during inflation – Convention says Treasury Inflation Protected Securities, commodities, and real estate do well in an inflationary environment. Real estate performed well during the period in the 1970s, when persistent inflation and high unemployment occurred.

- Demand may be coming back - Job creation and getting people employed are the two major factors in the housing rebound. There’s much debate about when the job market will recovery. Optimists say the recovery will happen this year, while pessimists say it won’t happen for several years.

Labels:

Bargins Deals and Steals,

Making Sense

Monday, February 7, 2011

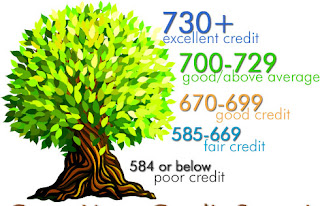

Your Credit Score will not be a Secret Any More!

And, you have the Dodd-Frank Financial Reform Bill to thank for it.

Starting July 21, 2011, lenders will have to provide you with your credit score if you are turned down for a loan OR are charged a higher rate than the “best” rate they have to offer.

In addition to letting you know your credit score, you will receive an explanation of the range of the score and a graph on how your score compares to other consumer scores.

Here are some tips if you are not happy about your score:

Over 2/3 of consumers haven’t ordered their free credit report in the last 12 months. Even if you aren’t applying for credit—you need to know what’s on your report!

Starting July 21, 2011, lenders will have to provide you with your credit score if you are turned down for a loan OR are charged a higher rate than the “best” rate they have to offer.

This applies to everyone—mortgage companies, auto dealerships, credit card companies, landlords, insurance agents, utilities—basically anyone who uses a credit score.

In addition to letting you know your credit score, you will receive an explanation of the range of the score and a graph on how your score compares to other consumer scores.

Here are some tips if you are not happy about your score:

- Contact the creditor who sent you your score and ask how many points are needed to get the best rates. If they tell you 15 or 20, it’s fairly easy to get it increased. If it’s 100, you’ve got your work cut out for you.

- If you’re planning on requesting credit in the future, order a credit report ahead of time and see what’s on it. The law allows you one free credit report every year -- www.AnnualCreditReport.com. However, a credit score is NOT included so consider buying your credit score ahead of time --ww.MyFico.com.

- Learn what goes into a credit score and http://www.scoreinfo.org/ has an educational website with great explanations on what influences credit scores.

Over 2/3 of consumers haven’t ordered their free credit report in the last 12 months. Even if you aren’t applying for credit—you need to know what’s on your report!

Labels:

Credit Issues,

Daily Real Estate News,

Making Sense

Monday, January 31, 2011

18 Questions to Ask A Real Estate Agent while Interviewing

If you are looking to buy or sell a home, you’ll probably want to not only find the best agent for your needs, but one with integrity and one that knows the ropes. They don’t have to be your best friend, but they should be someone that you genuinely like—because you’ll be spending a lot of time with them.

Start with recommendations from family and friends. Ask what they liked about them. What they didn’t like. And then take it one step further— spend about 30-45 minutes and ask them these questions!

- How long have you been selling residential real estate?

- Is it your full time job?

- What are your credentials?

- What other type of real estate training courses have you had?

- How many homes did you sell last year?

- How many buyers did you represent?

- What’s the average time to sell a home? (if listing your home for sale)

- How do you plan to market my home for sale?

- What’s the average time it took you to sell your listings?

- What’s the average time you spend with someone buying a home (if buying)?

- How close to the asking price, versus the sales price, are you able to negotiate (both for buyers and sellers)?

- Will you represent me exclusively (if you are a buyer)?

- How many lenders do you work with (if you need a mortgage)?

- Why do you like working with these lenders?

- What other service providers do you work with?

- Do you get any compensation when you refer them to me?

- How will you communicate with me?

- How often should I expect to hear from you?

Labels:

Daily Real Estate News,

What is?

Monday, January 24, 2011

5 Mortgage Qualifying Red Flags You Need to Know Before House Shopping!

What’s the first thing you do when you start working with a client? You ask the area, the type of home, the price range, etc. Next, you probably ask about their family, their employment and if they have been pre-qualified for a mortgage loan.

There are 5 mortgage qualifying situations that we have to be familiar with when looking at Rental Property or even homes. Good Agents don't want to waste your time showing you homes, so tell them up front!

There are 5 mortgage qualifying situations that we have to be familiar with when looking at Rental Property or even homes. Good Agents don't want to waste your time showing you homes, so tell them up front!

- Self-Employed Clients – A person is considered “self-employed” if they own 25% or more of any business. This includes partnerships and LLCs. Not only do I need 2 years’ tax returns, I have to have them sign a form, that’s sent to the IRS to verify the numbers. The red flags here are when someone says they have filed an extension—or they state they “don’t show all of their income” – or they “write off” all their expenses—and show no income.

- Divorced/Previously Divorced – Going thru a divorce can wreak havoc on a person’s credit. But more often than not, it’s the “joint debts” that still show up on the credit report that becomes a problem. This is especially true if the person had a mortgage with their ex-spouse and has not been released of liability. We will have to prove (with canceled checks) that the ex is paying the payments on time.

- Job-Hopping Clients – It’s not a bad thing if they change jobs, within the same industry, with very little time off between jobs. It shows a lack of “job stability” if a person hops from job to job or working for a “temp agency”.

- Foreclosure, Short Sale, Deed in Lieu – Simply put, there are pre-determined “waiting periods” before your clients can apply for a mortgage. There are shorter waiting periods for those who have had a short sale or deed in lieu (versus a full foreclosure), but the shorter the waiting period, the more money they’ll need for a down payment.

- Bankruptcy – Waiting periods apply here too, but it depends upon which “chapter of the bankruptcy code” they filed under. The bankruptcy has to have been “discharged” and all the paperwork, including a schedule of debts is needed for me to review. There are extenuating circumstances (medical, death of a spouse) which allows a shorter period of time—but divorce or job loss is not considered an extenuating circumstance.

Labels:

Daily Real Estate News,

Making Sense,

Mortgage News

Monday, January 17, 2011

Four things that will keep the Housing Market from Change in 2011!

As the new year gets underway, there are four housing issues consumers should keep a close eye on: Jobs, Foreclosure Delays, Washington, and Lending Standards and Rates.

- Jobs: If the job market improves, the demand for housing picks up, and many other challenges facing the housing market can more easily take care of themselves. However, if it doesn’t, home prices will decline further, and more homeowners will fall underwater.

- Foreclosure Delays: In September 2010, some of the nation’s largest lenders suspended foreclosures due to potentially fraudulent document-handling procedures. Regulators and state prosecutors have launched a series of reviews, and investigations could shed more light on abuses, such as misapplied or excessive fees by servicers, their attorneys, or other third-party vendors. If foreclosures are more difficult and expensive to process, banks and investors could step up bulk sales of loans or foreclosure alternatives such as short sales.

- Washington: This month, the Obama administration is set to issue an initial set of recommendations for how to remake Fannie Mae, Freddie Mac, and the broader mortgage market. Meanwhile, regulators also are writing new rules on provisions outlined in the Dodd-Frank Act that will clarify how banks must retain some of the risk on loans that are bundled and sold off as securities and define what constitutes a “qualified residential mortgage” that is exempt from such rules.

- Lending Standards and Rates: The government continues to dominate the mortgage-lending landscape, with more than nine in 10 new loans backed by Fannie Mae, Freddie Mac, or government agencies such as the Federal Housing Administration. While some analysts have raised red flags over the FHA’s finances and say that loans with 3.5 percent down payments are leading the agency to take on too much risk, others worry about tighter lending standards that could further pinch demand.

Labels:

Daily Real Estate News,

Making Sense

Monday, January 10, 2011

What You Should Never Bring to an IRS Audit!

The most common mistake is providing copies of your other years’ tax returns. What is really does is expand your risk of needing to provide more information because it gives an auditor many things to analyze, like patterns of income and deduction amounts over multiply years.

So, why do people bring their previous tax returns with them?

Because the IRS auditors ask them to!

But, according to the IRS rules, you are only required to bring the information relating to the specific tax year that is listed in the audit notice. You are not required to provide information from any other year (except maybe carryover items) even if the auditor verbally asks you to do so.

If the auditor asks for a previous return, simply say, “I don’t believe that this relates to the audit notice and the tax year mentioned.” Almost always, that will end the matter.

Labels:

Daily Real Estate News,

Tax Tips

Subscribe to:

Posts (Atom)